Tax financing agreement on $33 million project may go to voters

MIDDLEBORO — Voters at the Special Fall Town Meeting on Oct. 7 will likely be asked to approve a tax agreement with a manufacturing company looking to relocate to Middleboro and construct a $33 million facility on West Grove Street.

Representatives from Rexa, a manufacturer of electrohydraulic actuators now based in West Bridgewater, appeared before the select board Monday, Aug. 5 to discuss their plans for the site. The company has clients throughout the country and internationally, Director of Finance Kenneth Garron said. Electrohydraulic actuators are a type of hydraulic system that includes their own pumps.

Company officials also discussed their request for a TIF, which stands for Tax Increment Financing, that would provide a discount on future taxes for a period from five to 20 years.

The details of the agreement have not yet been finalized, but Town Manager James McGrail said after the meeting that the town is “ninety percent there’’ in making a determination on how much tax in incentives to offer. The amount can range from 1 to 100 percent, according to state regulations.

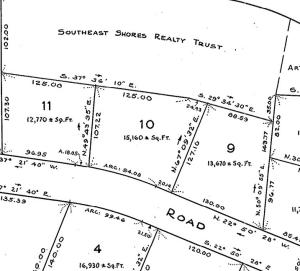

The company hopes to build an estimated 110,000 square foot building for corporate headquarters and manufacturing operations. The project cost is estimated at $33 million, including $7 million for land purchase, $20 million for hard and soft construction costs and $6 million for personal property costs.

Due to increased customer demand, the company needed to increase its real estate footprint, according to material presented by Rexa officials.

“This is a big project for us,’’ Garron said. “We’re looking at how to make the opportunity viable for us.’’

The company plans to create 25 new, permanent full-time jobs at the new location, in addition to the 100 full-time positions that will be retained. The company plans to give priority to qualified Middleboro residents for new jobs, Garron said.

Select Board Member Thomas White said he supported the preference to town residents and would make sure the company adhered to that commitment.

Rexa officials estimated that the company and its employees would spend about $1 million in town on various providers, including restaurants and catering, retail establishments, hotels, recreation and corporate and industrial services.

Garron said the company has a track record of supporting community non-profit organizations.

In response to a resident’s question, Garron said the truck traffic generated by the business would be “minimal,’’ which he estimated at about five to ten trucks a day, because the facility is used for manufacturing and is not a distribution site.

Select Board Member Brian Giovanoni described the project as “smart growth,’’ noting that, unlike with residential developments, a manufacturing facility would not add students to the town’s school system, which can be costly for taxpayers.

Select Board Chair Mark Germain said he planned to support the project.